Documents – Incentives

The links on this page open in a new window. To return to this page, simply close the new window.

Federal Incentives

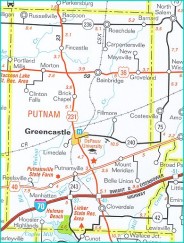

Two Census Tracts in Putnam County qualify for the use of New Market Tax Credits. One tract includes Greencastle’s industrial park. The other tract includes the I-70 and US 231 interchange in Cloverdale.

New Market Tax Credits – Fact Sheet

New Market Tax Credits – IRS Guidelines

The Courthouse Square Business District is listed on the National Register of Places. Many of the properties in the district qualify for the federal historic rehabilitation tax credits. There are also three residential districts in Greencastle and several individual listings on the National Register.

Historic Rehabilitation Tax Credits

Federal Tax Incentives for Preserving Historic Properties

20% Historic Rehabilitation Tax Credit

Incentive Guide for Income Producing Properties

Main Street Commercial Buildings

The links above provide a great deal of detail. Additional links can be found on each of the pages for details on eligibility, regulations, and case studies.

Work Opportunities Tax Credit (WOTC)

This is a federal credit to encourage employers to hire job seekers that traditionally had difficulty in finding employment. Applications can be filed on-line through the Indiana Department of Workforce Development. The amount of the credit ranges from $1,200 to $9,600 per new hire. To apply on-line through the Indiana Department of Workforce Development – CLICK!

State Incentives

The following links open in a new web page.

Indiana Economic Development Corporation – Tax Credits and Exemptions

Indiana Economic Development Corporation – Skills Enhancement Fund

Indiana Economic Development Corporation – Regulatory Ombudsman

Indiana Finance Authority – Tax Exempt Bond Program

Utility Incentives

The following link opens in a new web page.

Duke Energy – Smart Saver Incentive Program for Business

Duke Energy – Large Business – Energy Efficiency Services

Duke Energy – Rider 54 – Brownfield Redevelopment Rate

Duke Energy – Rider 58 – Economic Development Incentive Rate

Hendricks Power Cooperative – Power Moves – Custom Programs, HVAC, Lighting, and New Construction

Parke County REMC – Power Moves – Custom Programs, HVAC, Lighting, and New Construction

Links and information listed on this page are provided for information purposes only and not meant to be legal or accounting advice. Federal and state incentives should be reviewed in consultation with one’s legal and accounting advisors.

Updated 06/2014