Personal Taxes

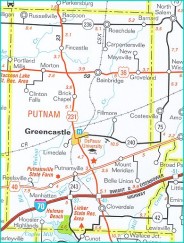

Residents of Indiana pay state and local income taxes, property taxes, and sales tax in order to support the operations of state and local government and the local schools. Below are summaries of these taxes. As each tax can impact a family or small business owner in a variety of ways, it is suggested that taxpayers should consult with their accountant or tax advisor to review their individual situation. The information provided below is not intended to be legal or accounting advice. The information is presented for a general understanding of the tax climate in Putnam County, its communities and the State of Indiana.

State of Indiana – Personal Income Tax

Generally, if you live in Indiana, work in Indiana, or have income from Indiana sources, you will have to file an annual individual income tax return with the Indiana Department of Revenue. The current state income tax rate is 3.4% for 2013. The rate will drop to 3.23% by 2017 in a series of steps. The rate is generally applied to one’s federal adjusted gross income, plus any Indiana add-backs, less any Indiana deductions, and less any Indiana exemptions to arrive at the state taxable income amount. For more information on the state’s income tax, please consult the Indiana Department of Revenue – Individual Income Tax Overview website – CLICK!

State of Indiana – Sales and Use Tax

The sales tax in Indiana is 7.0% on most purchases. Generally, food and prescription drugs and some services are exempt from sales tax. Certain food items such as candy, soft drinks or restaurant meals are subject to sales tax. Several communities around the state, including the Town of Cloverdale, have adopted an add on food and beverage sales tax.

Putnam County – Local Income Tax

Putnam County has a local income tax of 1.5%. Most of the revenue from this tax is used to replace local property taxes and to support economic development activities. The County Adjusted Gross Income Tax rate is 1.0% and the County Economic Development Income Tax rate is 0.5% for residents to arrive at the total rate of 1.5%. The total rate is 0.75% for non-residents that work in the county, if an income tax is not collected in one’s home county. The rate is paid on the state taxable income amount. Filing and payment are incorporated into the annual state personal income tax return.

Putnam County – Local Property Taxes

Property taxes are a primary source of funding for local government units, including counties, cities, towns, townships, libraries and special taxing districts. Some school funding support, other than the school general operating fund, are derived from property taxes. These funds are used to pay for a variety of services including public safety, local infrastructure, local government operations, facilities, welfare, school transportation and school facility maintenance and construction.

Property taxes are an ad valorem tax, meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayer’s property. Taxes are paid on the assessed value, known as True Tax Value, of any real estate and improvements less any deductions or exemptions. The Constitution of the State of Indiana limits the amount of property taxes paid on a homestead to 1% of the gross assessed value of the property. Farm ground and income producing residential property is limited at 2% of gross assessed value and commercial and industrial property is limited to 3%. For homeowners, generally personal property is not subject to local property taxes. Business personal property, including that used in a home based business, is subject to local property taxes. Taxes on business personal property are based on the depreciated cost of the property.

Property taxes are paid in arrears with payments due in mid-May and mid-November.

Sample – Local Property Taxes – City of Greencastle (For other tax rates throughout the county, see the Putnam County tax table – CLICK!):

Real Estate: 2013 Gross Rate – Payable 2014: $2.2535

(Rates are quoted per $100 of Assessed Valuation; Assessed Value is approximately 100% of market value)

As noted above, the property tax is an ad valorem levy on all tangible property (generally land, buildings, and business personal property) at rates varying according to the needs of the local taxing units and their assessed valuation.

Several deductions are available for homestead related property taxes. The most common are homestead, mortgage, old age, and veterans. Others are available for certain renewable energy systems, rehabilitation of older or historic properties, and for persons with disabilities. Most deductions can be obtained by making application to the Putnam County Auditor’s office located on the second floor of the Putnam County Courthouse. For more information on deductions and for application forms, visit the Indiana Department of Local Government Finance website – “Property Tax Deductions” – CLICK!

For general information about property taxes in the State of Indiana, please visit the Indiana Department of Local Government Finance website – “Citizen’s Guide to Property Tax” – CLICK!

For tax rates for each community and township in Putnam County, see the county tax table – CLICK!

Updated: 06/2014