Investment Incentives

Each of our communities and our county develop long lasting partnerships with our major employers. Local incentive pacakges for new investment and expansions are based on job creation, wage levels, and overall investment. Corporate citizens are expected to return the favor by investing in their employees and by supporting community projects and causes that improve the community. Over the years many of our companies have been supported in their efforts to expand and grow their local operations.

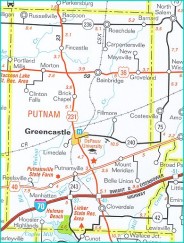

Generally state incentives are available throughout the state and are typically not limited by geographic locaition. Local incentive packages must be approved by the legislative body that governs the location of the proposed investment. In Greencastle, any incentive package must be approved by the Common Council. In the towns, the Town Council must take action. In the unincoproated areas of the county, the County Council takes action. Although all of the taxing units that make up the tax rate must be notified when certain incentives such as local property tax abatement are to be granted, a company is not required to seek approval from each and every taxing unit. The decision rests with the legislative body governing the location of the proposed investment.

The following links describe the investment incentives that may be available for a proposed project or expansion. State law governs the nature of, limitations, and adoption process for local investment incentives.

Bainbridge Investment Incentives

Cloverdale Investment Incentives

Fillmore Investment Incentives

Greencastle Investment Incentives

Roachdale Investment Incentives

Russellville Investment Incentives

Putnam County Investment Incentives (unincorporated areas only)

State of Indiana Investment Incentives

Greencastle – Stellar Communities

As part of its efforts to encourage ongoing investment in the Courthouse Square Business District, the City of Greencastle want to make investors aware of some unique investment incentives such as the 20% federal investment tax credits available for the renovation of structures listed on the National Register of Historic Places.

More details can be found by reviewing the Courthouse Square Investment Incentives.