Fillmore Investment Incentives

The Town of Fillmore establishes a partnership with a firm based on the number of jobs created, wage levels, and amount of investment. Many of the incentives listed below can be used for future expansions after locating in the community.

Tax Abatement

Local government will consider granting real property tax abatement on a new facility or improvements to an existing facility for up to 10 years. Ten year abatement results in significant savings in property taxes over the period. Under state law, property taxes on an existing facility cannot be abated.

Local government will also consider abatement on eligible personal property. With past projects, the Town of Fillmore has developed partnerships that have resulted in the granting of up to 10 years of tax abatement on real property and up to 10 year abatement on manufacturing and distribution equipment.

Under current state law, abatement can be granted for up to 10 years on real property, manufacturing equipment, distribution equipment, information technology equipment, and research and development equipment. Each request for abatement is given careful consideration by the Town Council.

Project Financing – Ports of Indiana Lease Financing

The Ports of Indiana now have statutory authority to offer lease financing throughout the state. This method of development financing involves the use of the agency’s bonding authority to build or expand a facility on behalf of a private company. The company then repays the bond through a lease agreement. This allows the company to treat the cost as an operating expense rather than a capital investment, improving balance sheet ratios and conserving capital for other needs. The State views this type of development financing as a “tie-breaking” economic incentive, used in consultation with state, local and economic development officials to solidify agreements with companies that might otherwise locate in another state or not pursue the project at all.

Project Financing – USDA Business and Industry Loan Guarantee

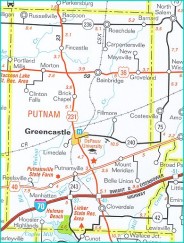

As a rural county, Putnam County is an area where businesses can access the USDA’s Business and Industry Loan Guarantee Program. The program provides a loan guarantee to lenders that provide financing for projects in rural areas. The guarantee can be provided on loans that finance real estate, equipment, and/or working capital. The amount of the guarantee depends on the level of borrowing. Companies must meet a 51% domestic ownership threshold.

Infrastructure Improvements

Projects that require infrastructure improvements such as streets, water lines, sanitary sewer line, telecommunications, etc., can receive assistance through the State of Indiana. The Industrial Development Grant Fund provides grants to local units of government to aid in providing infrastructure for industrial development.

Tax Credit – State of Indiana – EDGE

The Economic Development for a Growing Economiy (EDGE) Tax Credit provides an incentive to businesses to support job creation, capital investment, and improvements to the standard of living for Indiana residents. This refundable corporate income tax credit is calculated as a percentage (not to exceed 100%) of the expected increased tax withholdings generated from new job creation. The credit certification is phased in annually for up to 10 years based upon the employment ramp-up outlined by the business.

To be eligible for the tax credit, a project must:

- Result in net new full-time permanent jobs that were not previously performed by employees of the applicant.

- Result in significant new capital investment in Indiana.

- Be economically sound, increase opportunities for employment, and strengthen the economy of Indiana.

- Receiving the tax credit must be a major factor in the applicant’s decision to move forward with the project. Not receiving the tax credit will result in the applicant not creating new jobs in Indiana.

- Have significant offers of local incentives in support of the project.

Applications are evaluated based on individual merits, a cost benefit analysis, and whether or not the project meets the legal requirements set forth in Indiana Code 6-3.1-13.

Tax Credit – State of Indiana – Hoosier Business Investment Tax Credit

The Hoosier Business Investment (HBI) Tax Credit provides an incentive to businesses to support job creation, capital investment, and improvements in the standard of living for Indiana residents. This non-refundable corporate income tax credit is calculated as a percentage of the eligible capital investment made to support the project. The credit may be certified annually, based on the phase-in of eligible capital investment, over a period of two full calendar years from the commencement of the project.

Qualified investments may be made only during taxable years ending on or before December 31, 2016. Eligible capital investment includes new machinery and buildings costs associated with the project as outlined in state law. A person or business that proposes a project to create new jobs or increase wage levels must apply to the Indiana Economic Development Corporation for approval of an award of the Credit prior to the investment.

To be eligible for the tax credit, a project must:

- Result in net new full-time permanent jobs that were not previously performed by employees of the applicant.

- Result in significant new capital investment in Indiana.

- Be economically sound, increase opportunities for employment, and strengthen the economy of Indiana.

- Receiving the tax credit must be a major factor in the applicant’s decision to move forward with the project. Not receiving the tax credit will result in the applicant not creating new jobs in Indiana.

- Have significant offers of local incentives in support of the project.

Applications are evaluated based on individual merits, a cost benefit analysis, and whether or not the project meets the legal requirements set forth in Indiana Code 6-3.1-26.

Job Training – State of Indiana – Skills Enhancement Fund

The state’s Skills Enhancement Fund (SEF) provides assistance to businesses to support training and upgrading the skills of existing and/or new employees required to support new capital investment. Up to 50% of eligible costs such as instructor wages, tuition, and training materials can be paid for through a grant. Eligible uses include training to enhance basic skills, transferable skills, company specific skills, and quality assurance skills. Grants typically cover a two year period from the commencement of a project.

To be eligible for a grant, a project must indicate that the training is:

- Required to support new capital investment in Indiana.

- Required to support the retention and/or creation of full-time permanent jobs for Indiana residents at the project location.

- Eligible for reimbursement under state law. Some training expenses such as trainee wages, orientation training, and safety training required by OSHA are not eligible for reimbursement.

Applications are evaluated based on individual merits, a cost benefit analysis, and whether or not the project meets the legal requirements set forth in Indiana Code 5-38-7.

State of Indiana – Investment Incentive Programs

For additional information about state programs, contact the Indiana Economic Development Corporation at 317-232-8800. Program descriptions can be found on the web at iedc.in.gov click on “Tax Credits & Exemptions” button and the “Programs & Initiatives” buttons. Applications and fact sheets can be found on the IEDC’s downloadspage at iedc.in.gov/business-resources/downloads.

Job Training – WorkOne – On-The-Job-Training Reimbursement

WorkOne of Western Indiana can provide reimbursement to a company of up to 50% of the wage rate of the training participant, during the agreed prescribed training period. Trainees must be eligible for federal Workforce Investment Act (WIA) services and require training and skill upgrades to meet the needs of the employer. WIA funding (through the US Department of Labor) is allocated on an annual basis and cannot be encumbered prior to the program year. Generally these funds cannot be used in support of a business relocation project that results in the loss of jobs in another part of the country.

WorkOne Business Team staff work with companies to insure that if the Department of Labor continues to make funds available in future years, the company will be eligible to pursue reimbursement. The value of the reimbursement is determined based on the number of employees trained and the length of the training period as allowed under program guidelines. From time to time, funds may be limited or available on a first come, first served basis.

Employee Recruitment and Screening

WorkOne of Western Indiana offers a wide range of assistance to employers from recruitment, skills testing, and initial screening, to providing interview rooms. The services are available at no charge to an employer. The local office provides the services of a state employment office.

Under a partnership with the Department of Workforce Development, offers WorkKeys testing and Prove It! testing to help employers evaluate the soft and hard skills of employment candidates. These tests are available at no charge to an employer.

WorkKeys

WorkOne Western Indiana in cooperation with the Indiana Department of Workforce Development can offer ACT’s WorkKeys job and employee evaluation program. Under the program, a job profile is developed that outlines the necessary skills required to successfully work in the position. Employment candidates are then evaluated to determine their skill levels and match to the job. Skill training is available to help employment candidates improve their skill levels. These services are available at no charge. Information from ACT indicates that providing a better match between job and employee results in decreased turnover, better productivity, and increased job satisfaction, thus lowering costs for the employer.

Technical Assistance

The Greencastle/Putnam County Development Center is available to provide technical assistance to insure the success of a project. The Center typically aids clients in their work with local and state government, assists with grants applications, and provides the services necessary to make the transition from announcement to operation as smooth as possible. The Center also has a team of experts from engineers to employment specialists that can be called upon to assist a project.

Updated 11/2013