Business Taxes

In 2002, the Indiana General Assembly passed a historic revision of Indiana’s tax code. The bill simplified and modernized the state’s tax structure. Additional changes occurred several past legislative sessions. In 2008, the General Assembly passed revisions to local property taxes which resulted in constitutional caps on local property taxes. Because of this legislation and annual revisions, it is recommended that a company review their business situation with their tax accountant.

Single-Sales Factor

Indiana is phasing in the single-sales factor for apportioning corporate income tax. Indiana had determined its share of an interstate or international corporation’s taxable income by weighing the Indiana portion of a company’s property, personnel and sales. The single-sales factor will calculate the Indiana portion of a corporation’s tax based solely on the portion of a company’s sales in Indiana. This change in the Indiana tax code was completed in 2011.

The Indiana Economic Development Corporation can provide detailed tax estimates for state taxes.

Indiana Corporate Adjusted Gross Income Tax

All corporations, except S corporations and not-for-profit organizations, doing business in Indiana are subject to the Corporate Adjusted Gross Income Tax.

During the 2011 legislative session, House Enrolled Act 1004 was passed and signed into law. The legislation lowers the rate from 8.5% to 6.5% in four steps over a four year period beginning on July 1, 2012 and ending June 30, 2015. In the 2014 session of the legislature, adoption of Senate Enrolled Act 1 further reduces the corporate income tax in a series of steps to 4.9% as of July 1, 2021. The application of the rate depends on a company’s fiscal year and its relation to the phase in schedule.

The rate is paid on federal taxable income with four modifications:

- Subtract any income that federal law or the Constitution prohibits Indiana from taxing.

- Add deductions allowed under federal law for charitable contributions.

- Add deductions allowed under federal law for state income taxes and local property taxes.

- Apportion income to Indiana based on the average percentage of property owned in Indiana, percentage of payroll paid in Indiana, and twice the percentage of sales volume attributable to Indiana. (See note on phase in of Single-Sales Factor above.)

Indiana Unemployment Tax

Employers pay unemployment tax on the first $9,500 of an employee’s wages. After January of 2011, for new employers, the starting rate is 2.5%. The rate for experienced employers averages about 1.9%.

House Enrolled Act 1379, passed in early 2009, makes several changes to the state’s unemployment system that became effective in 2011. After 2011, a range of 0.70% to 4.8% will be used for companies with a credit balance. The range will be 6.3% to 9.5% for companies with a debit balance. Because of this legislation, it is recommended that a company review their business situation with their tax accountant.

The maximum weekly benefit is $390.

Indiana Worker’s Compensation Tax

The average rate for manufacturing is $2.22 per $100 of Indiana payroll. The range is from less than $1.00 to $5.00 depending on the nature and hazard ratings of the industry. The current average rate for office workers is $0.26 per $100 of Indiana payroll.

Employers may also self insure for worker’s compensation.

The maximum weekly benefit equals 2/3 of average weekly wages/salary up to a maximum of $650 per week.

It is recommended that a company consult state law and regulations to determine their specific responsibilities in this area.

Indiana Sales and Use Tax

Purchasers of tangible personal property, public utility services, renters of room or other accommodations for less that 30 days, and renters of other property pay a 7% sales tax on the sales price of the taxable transaction.

Exemptions include wholesale sales; purchases of items used directly in the production process, including raw materials, machinery, tools and equipment directly used in production; any sale of goods for resale; sales made in interstate commerce; power, electricity, and natural gas if 51% of the load is used for manufacturing; pollution abatement equipment if required by federal, state, or local law; and, sales to government entities. Generally food, not including such items as candy, soft drinks or restaurant meals, and prescription drugs are also exempt.

Research and development equipment acquired after June 30, 2007 is completely exempt from Indiana sales tax.

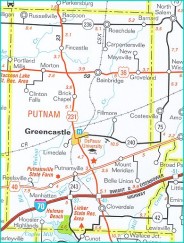

Local Property Taxes – City of Greencastle – Example

Real Estate: 2013 Gross Rate – Payable 2014: $2.2535

(Per $100 of Assessed Valuation; Assessed Value is approximately 100% of market value)

The property tax is an ad valorem levy on all tangible property (land, buildings, and personal property) at rates varying according to the needs of the local taxing units and their assessed valuation. Real property (land and buildings) are assessed at 100% of True Tax Value as of the last general real property assessment. The True Tax Value is similar to market value with some adjustments.

Personal Property: 2013 Gross Rate – Payable 2014: $2.2535

(Per $100 of Assessed Valuation; Assessed Value is based on the depreciated value of the personal property)

Personal property is assessed annually. Personal property is subject to depreciation schedules with the tax rate applied after the application of depreciation schedules. With the 2006 pay 2007 tax payments, tax on inventory has been eliminated.

Property taxes for commercial and industrial properties and equipment are capped at a maximum of 3% of assessed value under an adopted constitutional amendment.

Tax rates for each taxing unit in the county can be found in the Putnam County – Local Property Tax Table – CLICK!

Personal Property Tax Exemptions

The Indiana Administrative Code provides local property tax exemptions for the following classifications of property:

Application Software (50 IAC 4.2-4-3(f))

Industrial Air Pollution Control Equipment (50 IAC 4.2-11.1-1)

Industrial Wastewater Control Facilities and Equipment (50 IAC 4.2-11.1-2)

The property must meet the legal definitions and requirements to qualify. Please review the appropriate sections of the Indiana Administrative Code to determine its application to your company’s situation.

Real and Personal Property Tax Abatement/Phase In

Property Tax Abatement/Phase In is authorized under Indiana Code 6-1.1-12.1 in the form of deductions from assessed valuation. Any property owner in a locally designated Economic Revitalization Area who makes improvements to the real property or installs new manufacturing, logistics/distribution, information technology, and/or R & D equipment is eligible for property tax abatement. Land does not qualify for abatement. Used equipment can also qualify as long as such equipment is new to the state of Indiana. Equipment not used in direct production, such as office equipment, may not qualify for abatement.

Since July 1, 2000, tax abatement can be granted on a one to ten year declining percentage schedule on real property improvements such as buildings.

Personal property tax abatement is a declining percentage of the assessed value of the newly installed equipment, based on a one to ten year time period and percentages as determined by the local governing body.

Also, since July 1, 2000, tax abatement changes now allow local units of government to grant tax abatement on research and development equipment from 1 to 10 years.

As of July 1, 2005, tax abatement is also available on distribution equipment and information technology equipment.

Information presented here is not to be considered accounting or legal advice. Please check with your accounting and legal advisors to determine how Indiana’s property tax law may impact your situation.

Updated: 06/2014